Evaluating Your Health Benefits Needs

Matthew Frye-Castillo

“The best time to think about your benefits isn’t during a crisis — it’s during open enrollment.”

Choosing the best healthcare plan for the year isn’t a once-a-year task that you have to dread. More accurately, it’s an opportunity to reassess your priorities and protect your financial and physical well-being.

Every situation is different, and selecting the right coverage begins with understanding what you need and what’s available. The following brief guide will help you pick the perfect plan for your particular set of circumstances.

Start with the Basics: Who Needs Coverage? What Kind?

Before exploring plan types or premiums, begin by defining who the plan will cover. Is it just for you? A spouse? Children? Your entire family?

Next, think about what kind of care is most important.

Do you need coverage for regular checkups and screenings, or for more specialized services like maternity care, chronic conditions, or mental health support? Your answers to these questions will help narrow the options to those that actually align with your lifestyle and needs.

Review What Coverage Is Available

Many employees have access to plans offered through their employer, but it’s worth exploring whether a spouse or domestic partner’s benefits offer better coverage or cost savings.

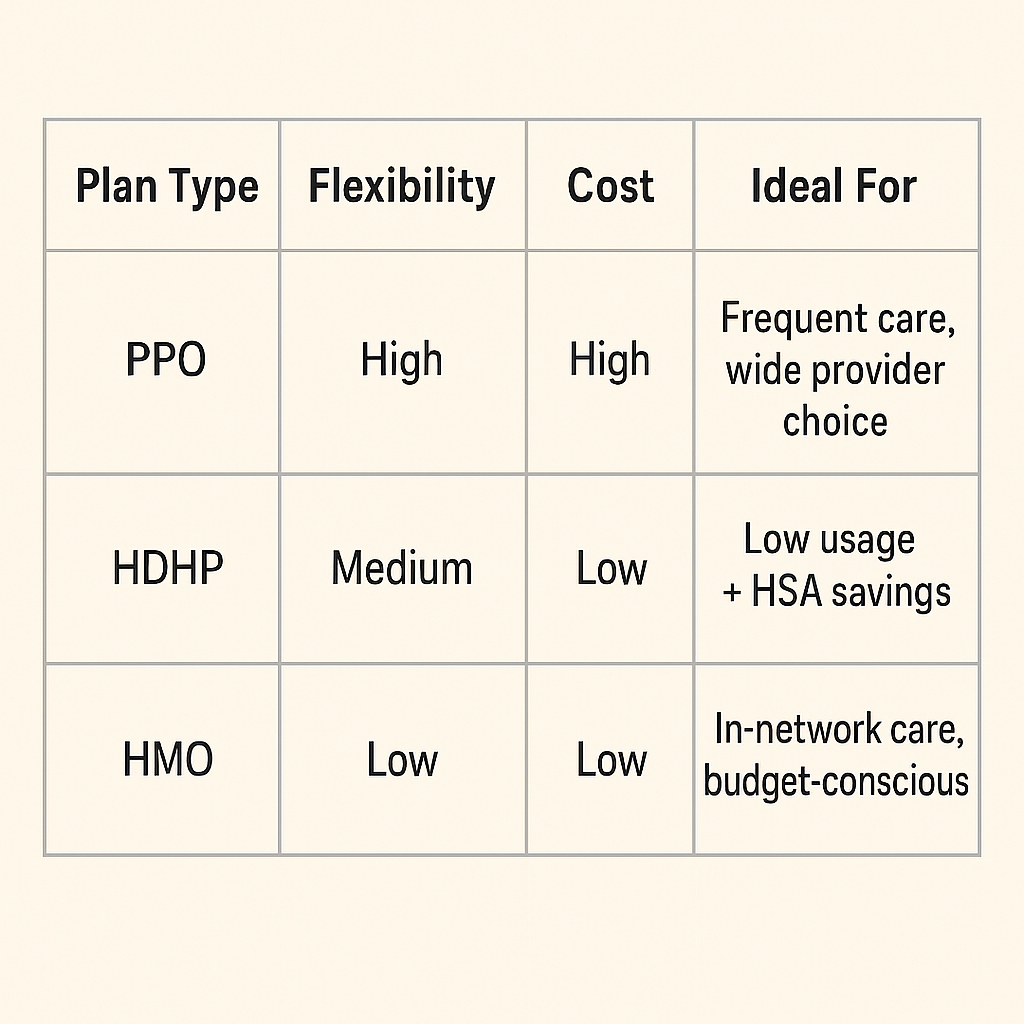

Some plans to consider include:

Employer-paid or subsidized plans

High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs)

Flexible Spending Accounts (FSAs) for predictable health or childcare expenses

Dental and Vision plans (sometimes optional, but important for long-term wellness)

Understanding what’s on the table ensures you’re making a fully informed decision.

Know the Key Terms Before You Compare

As Benefits Supervisor Charlotte Molander explains, “It’s not just about what plan sounds good — it’s about understanding what the numbers really mean.”

When comparing options, look at:

Deductibles – the amount you pay before insurance kicks in

Copays and Coinsurance – your share of costs for services

Out-of-Pocket Maximums – the most you’ll pay in a year

Prescription Coverage – which medications are included and at what cost

Monthly Premiums – how much comes out of your paycheck each month

Sometimes a higher premium plan can save you more in the long run, depending on your healthcare needs.

Think Beyond Health Insurance

Health benefits extend beyond medical care. As part of your overall financial stability, take time to review:

Retirement plans

Life and disability insurance

Emergency fund contributions

Planning holistically ensures that your benefits package supports not just your health, but your financial future.

“Review your plan annually. Your life changes, and your benefits strategy should evolve with it”

Talk to People and Use Your Tools

When evaluating plans, don’t go at it alone. Talk with your family about what matters most, and consult HR or benefits professionals if you need help deciphering the details.

Leverage available technology when available. Many benefits platforms include comparison tools, estimators, and mobile access that make enrollment and ongoing use easier to manage.

The Takeaway

Taking time to evaluate your benefits needs isn’t just about getting coverage, but about finding peace of mind. The right plan helps ensure you and your loved ones have access to the care you need, without unnecessary financial stress.

As your life changes, so should your benefits strategy. Make reviewing your plan part of your routine, not just your to-do list.